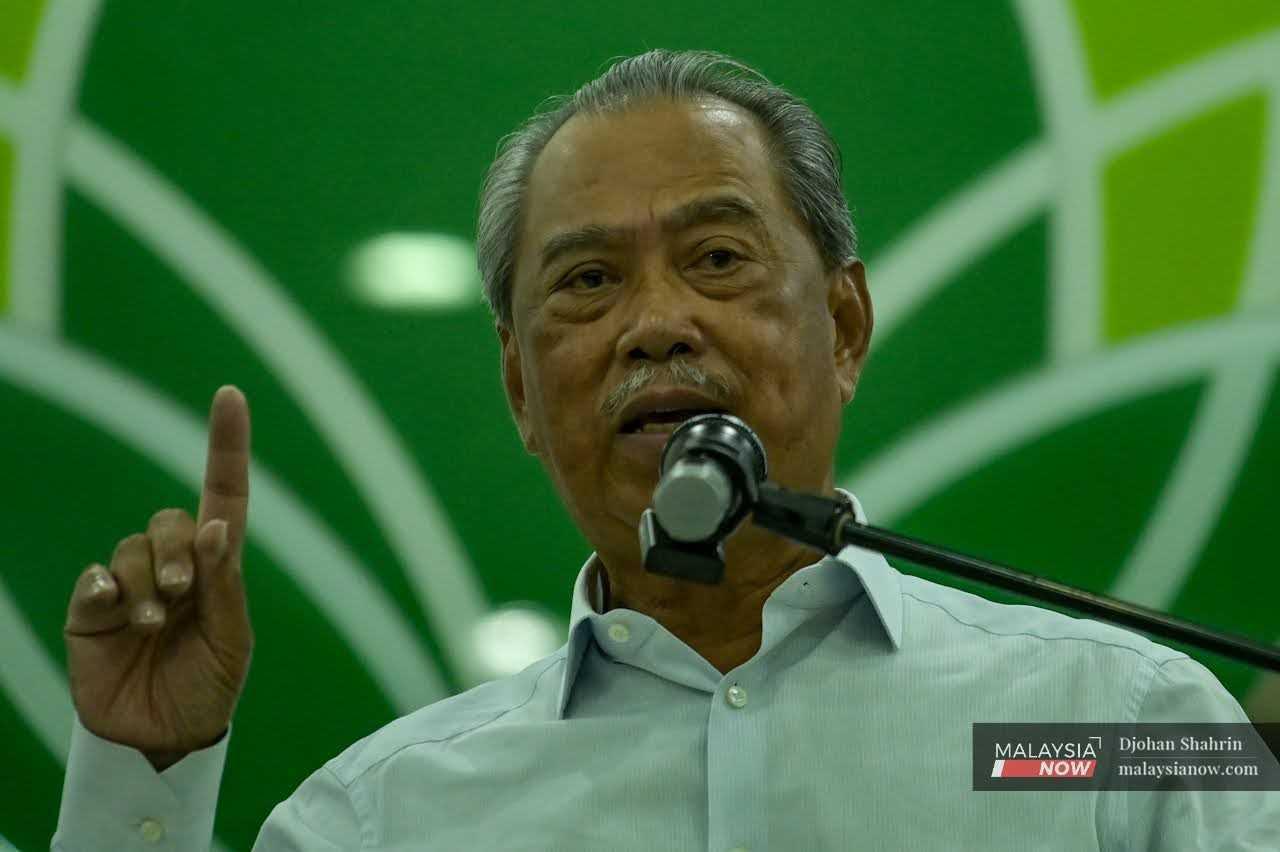

Muhyiddin urges concrete, pragmatic response to solve bankruptcy

The former prime minister also warns about the financial risks posed by the rapidly growing 'buy now, pay later' trend in the country.

Just In

Perikatan Nasional chairman Muhyiddin Yassin has called on the government to implement concrete and pragmatic policies to address the issue of insolvency in the country.

Muhyiddin, who is also Pagoh MP, said the government should emphasise efforts to assist bankrupt individuals to rebuild their economies.

"This is to ensure bankruptcy does not remain a lifelong status and instead motivates the group to contribute to the country's economy.

"One way is to review the bankruptcy discharge process for Malaysians working abroad as it takes a long time to obtain a court order and seek permission from the immigration department," the former prime minister said during the debate on the Insolvency (Amendment) Bill 2023 in the Dewan Rakyat today.

Muhyiddin's administration, in 2020, enacted the Covid-19 Act, which raised the threshold for bankruptcy from RM50,000 to RM100,000.

In the amendment, two categories qualify for bankruptcy discharge, namely individuals with mental illnesses and those aged 70 and above.

The bill was presented by Minister in the Prime Minister's Department (Law and Institutional Reform) Azalina Othman Said for its first reading two days ago.

It aims to strengthen provisions related to automatic discharge, mandatory first creditors' meetings and the use of distance technology in bankruptcy administration funds.

In a statement, Azalina said an average of 16 bankruptcy cases were filed each day in 2022, while the KPI for discharged bankruptcies during the same period was 27 cases per day.

Muhyiddin said 64.8% of bankruptcy cases involved amounts ranging between RM100,000 and RM499,999, while 20.96% involved values from RM50,000 to RM99,000.

"So how does the government plan to resolve bankruptcy cases involving debts exceeding RM50,000, considering that around 130,000 or 50% of the 260,000 cases are eligible for discharge?" he asked.

Muhyiddin then suggested that the government examines the Congress of Unions of Employees in the Public and Civil Services' proposal to extend the repayment period for personal loans and vehicle hire-purchases to 20 years to increase the disposable income of the people.

He also questioned the effectiveness of regulating credit services like "buy now, pay later" (BNPL), which are becoming increasingly popular among people.

"Most BNPL services, especially those related to e-commerce platforms, charge high-interest rates if monthly installments are delayed.

"The interest rates can be considered higher than those for credit cards," he said.

He added that BNPL poses a risk of further exacerbating household debts if there is no intervention from authorities.

Subscribe to our newsletter

To be updated with all the latest news and analyses daily.