Ringgit is fourth most undervalued currency, says latest global purchasing power index

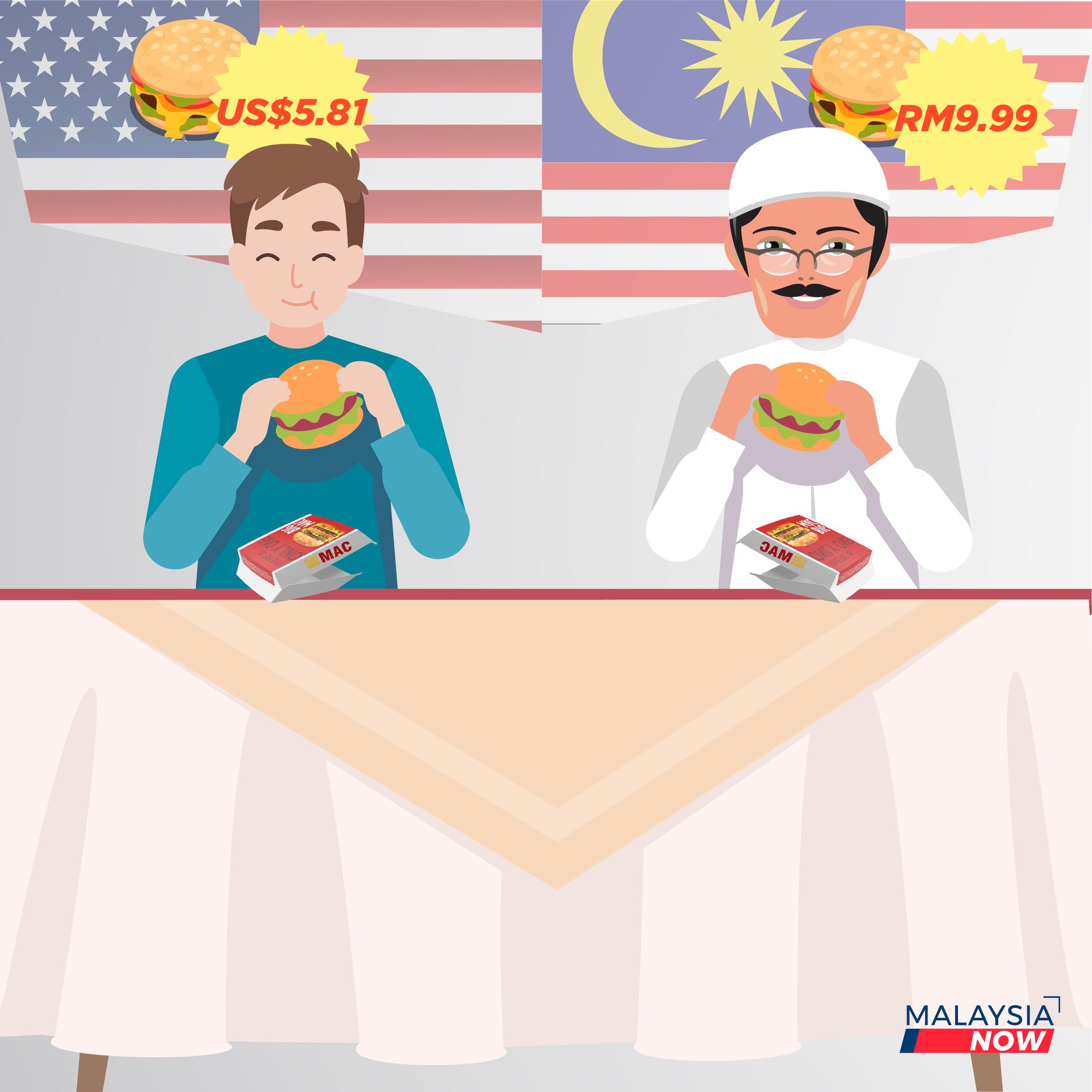

A comparison of purchasing power through the price of the iconic Big Mac burger suggests that the ringgit is undervalued by as much as 58.9%.

Just In

The Malaysian ringgit should be worth 58.9% more against the US dollar, or RM1.72 per dollar, instead of its current level of around RM4.19, according to the latest Big Mac Index released this week by The Economist.

Since 1986, the Big Mac Index has been comparing purchasing powers around the world using the price of the world’s most recognisable burger as its benchmark.

The index is based on the theory of purchasing-power-parity (PPP), or the notion that in the long run, exchange rates should move towards the rate that would equalise the prices of an identical basket of goods and services in any two countries.

The index, which the Economist says is never not to be taken as a precise gauge of “currency misalignment”, has now been globally accepted.

In its latest edition, the ringgit emerges as the fourth most undervalued of 55 currencies tracked, each measured by GDP per capita and after taking into account differences in the standard of living.

“A Big Mac costs RM9.99 in Malaysia and US$5.81 in the US,” the survey report said.

“The implied exchange rate is 1.72. The difference between this and the actual exchange rate, 4.19, suggests the ringgit is 58.9% undervalued,” it added in reference to the ringgit’s market value earlier this week.

What this means is that anyone who earns in ringgit will be able to buy fewer things in the US or any other country because the currency is undervalued.

But the ringgit is not alone.

Among the world’s other most undervalued currencies on the Big Mac index are the Turkish lira, undervalued by 67.9%, the Indonesian rupiah (undervalued by 59.3%) and the Russian ruble (undervalued by 70%).

Meanwhile, the index finds the Swiss franc and the Norwegian krone as the world’s most overvalued currencies.

The raw index does not tell the full story of currency valuation.

Due to PPP, the cost to produce a Big Mac is cheaper in poorer countries.

To address this, The Economist said it has factored in another important indicator – GDP-adjusted index – to reach a more accurate conclusion.

At market exchange rates, a Big Mac costs US$2.39 in Malaysia, 58.9% less than in the US (US$5.81).

But based on differences in GDP per person, a Big Mac should cost 37.2% less.

This suggests that the ringgit is 34.6% undervalued.

“It is worth pointing out that it is common for poor countries to seem cheap relative to rich ones in any simple comparison of prices,” The Economist said, noting that in most countries, “the price of a burger is about what you would expect given the country’s GDP per person”.

On the adjusted index too, Malaysia’s currency remains heavily undervalued at sixth place, but less so than when dealing with straight conversion data.

Using this measure, the Russian ruble is the most undervalued currency relative to the US dollar, by as much as 52.1%.

This is below the Romanian leu at 36%, the Hong Kong dollar at 45% and the Taiwanese dollar at 38.5%.

Adjusted for GDP per capita, Uruguay has the most overvalued currency at 39.8%.

Subscribe to our newsletter

To be updated with all the latest news and analyses daily.