Questions raised over half-a-billion ringgit govt loan for troubled AirAsia

The approval from Danajamin comes months after the airline was classified as PN17.

Just In

A half-a-billion loan given to troubled airline AirAsia through the use of a government credit facility has raised eyebrows among aviation industry observers.

In October last year, AirAsia announced that it had received approval for an 80% guaranteed loan of up to RM500 million from Danajamin Nasional Bhd, a financial guarantee insurer under the finance ministry-owned Bank Pembangunan Malaysia.

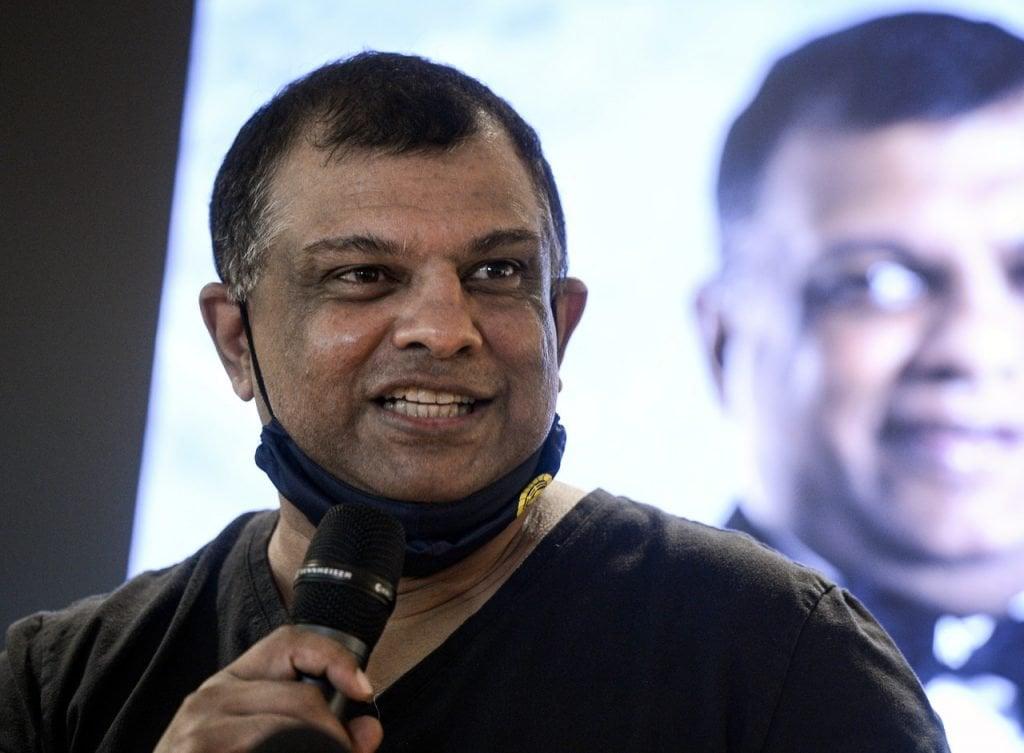

The approval for AirAsia, the budget carrier helmed by Tony Fernandes, came less than six months after the bank named Nazir Razak, the former chairman of CIMB Group and the brother of former prime minister Najib Razak, as its new chairman.

The scheme under which AirAsia got the loan was introduced by then prime minister Muhyiddin Yassin following the Covid-19 outbreak, and is aimed at providing immediate and targeted working capital support to companies adversely impacted by the pandemic.

But what raises questions is the fact that the whopping loan amount was passed despite AirAsia’s classification as PN17, a reference to “Practice Note 17/2005”, the document issued by Bursa Malaysia labelling companies facing financial troubles. A company classified as PN17 is also required to submit a restructuring plan to the Securities Commission.

AirAsia was classified as PN17 on Jan 13 after Bursa Malaysia dismissed its appeal to extend by 18 months its clearance period ending Jan 7.

One aviation analyst said there had been no sign so far that companies like AirAsia could recover from the impact of the pandemic.

Shukor Yusof said the emergence of the Omicron Covid-19 variant, although apparently less severe than the Delta strain, continues to haunt businesses.

“The government should have set conditions when approving Danajamin’s contribution and received benefits from AirAsia as the money belongs to the people,” Shukor, a former Standard & Poor’s analyst with over two decades’ experience in the aviation industry, told MalaysiaNow.

He said the government could have set a six-month period for AirAsia to prove that it is capable of shaking off its PN17 status and ensuring a recovery of operations.

Shukor said it was no issue for the government to approve the funds, but that there were concerns about AirAsia’s current direction or lack thereof.

He said while AirAsia had embarked on a range of initiatives such as venturing into other areas of business, the worry was that this might only add to the financial pressure which appeared to be at a critical level.

The budget airline has recorded losses for the last two financial years, posting a net loss of RM283 million in FY 2019 and RM5.89 billion in FY 2020.

“In these challenging conditions, it has involved itself in business ventures that have nothing to do with air travel, like e-hailing, drones, food delivery and so on.”

Shukor also referred to the statement by AirAsia’s Fernandes that it would become an investment company.

“If this is true, the government should not step in,” he said, adding that Danajamin’s intention was to strengthen the company’s finances for airline operations.

AirAsia came under attack from its customers after it said it would not refund them for flights cancelled due to the pandemic.

Instead, the company said it would dish out credit to tens of thousands of affected passengers.

Despite being flooded with customer complaints, Fernandes has announced expansion plans for AirAsia, including the launch of a “super app”.

But Shukor is not convinced.

“While the new business through the launch of the AirAsia Super App is expected to generate some revenue for the group, it will not be the same as the revenue generated through the airline business,” he said.

Shukor nonetheless agreed with the government’s move to help AirAsia through Danajamin given its contributions to the economy before the onslaught of Covid-19.

“AirAsia contributed to the flight ecosystem in Malaysia, and it played an important role in bringing tourists into the country before Covid-19,” he said.

“If the government does not help, the company might begin to face other bigger problems like suspension or bankruptcy. This would further complicate the situation as AirAsia is closely linked with the supply chain in, for instance, the tourism and hotel industries.”

But Shukor believes that AirAsia, like other airline companies, has an uphill task ahead in restoring its flight operations given that Covid-19 infection remains a global threat.

“It has been categorised as PN17, but it can still overcome this if it can prove to Bursa Malaysia and its investors that the company is capable of financing its operations, assuming that it can get financial support from other parties.”

Fernandes had remained optimistic that his airline would be profitable again after having survived 16 months of being grounded.

He also said that AirAsia was forming a plan to streamline its financial position to tackle its PN17 status.

AirAsia managed to raise more than RM2.5 billion through fundraising activities including private placements of RM336.48 million in the first quarter of 2021.

It raised another RM974.51 million through the issuance of deductible rights from redeemable convertible unsecured Islamic debt securities for a period of seven years, and plans to raise additional capital of up to RM400 million this year.

Subscribe to our newsletter

To be updated with all the latest news and analyses daily.