Experts tell why Tesla chose Indonesia over Malaysia

While several factors could have played a role in the decision, it does not reflect badly on Malaysia's ability to attract foreign investments, they say.

Just In

Automotive experts say that Tesla Inc’s decision to invest in Indonesia instead of Malaysia should come as no surprise, although it does not reflect badly on Malaysia’s ability to attract foreign investors.

Speaking to MalaysiaNow, automotive expert Daniel Fernandez said Malaysia’s national automotive policy or NAP was not as clear as that of its neighbours.

He said this would affect investment decisions made by other automotive companies as well, not just Tesla.

“In Indonesia, Thailand and Singapore, they explain clearly what sort of incentives are provided for international automotive companies who invest in the country,” Fernandez, who runs automotive news site DSF.my, said.

“This lets the companies in question lay out their plans in detail before making any decision to invest in the country of their choice.”

Chips Yap meanwhile said that the NAP policy functioned as a form of protection for local vehicle brands by foreign automotive companies, ultimately creating the perception of Malaysia as a biased market.

According to Yap, who runs PISTON.my, foreign automotive companies see the NAP as an invitation to invest in the country, but with limited sales so that local products are given the advantage.

“This situation would encourage more open market investors such as Indonesia and Thailand as they do not have local products,” he said.

“Indonesia also has a larger market – that alone would be a factor in attracting investors.”

Nevertheless, Yap said the policy did not mean that foreign automotive companies would reject Malaysia entirely – only that their investments would be on a smaller scale.

Fernandez meanwhile said the government might be more focused on other fields such as the IT industry, where Malaysia has strong investments.

“Perhaps the government is not chasing car companies to open up shop here, preferring instead for international companies to transfer their technology to Malaysia,” he said.

“We have the expertise,” he added. “Even Foxconn (Hon Hai Precision Industry Co Ltd) recently said that it would invest in Malaysia.”

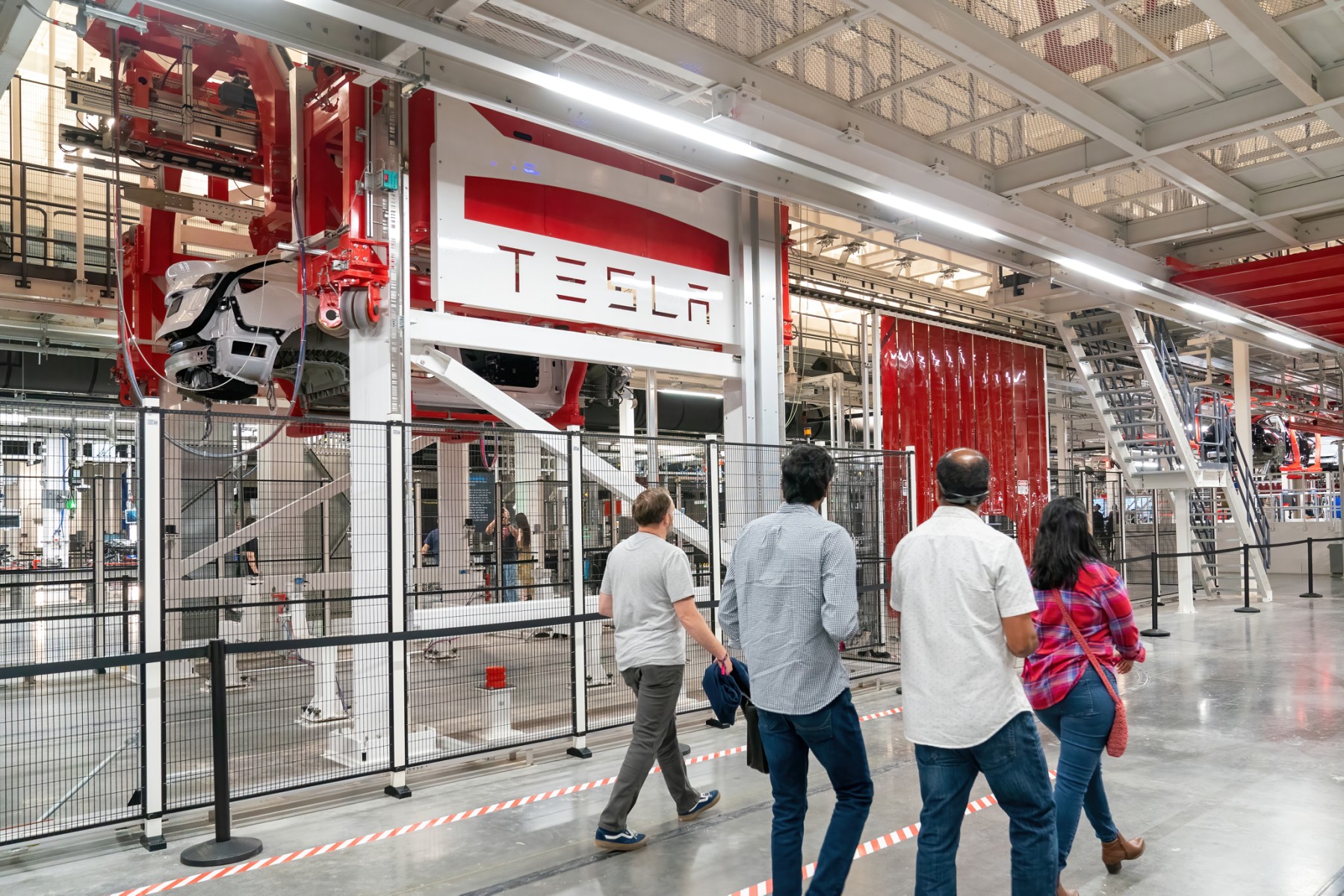

Their comments follow the circulation of pictures showing a meeting between Tesla CEO Elon Musk and Indonesian President Jokowi Widodo.

Many internet users had mocked the government, including Prime Minister Ismail Sabri Yaakob, saying it seemed as though foreign companies were more interested in investing in Malaysia’s neighbours than in Malaysia itself.

International Trade and Industry Minister Mohamed Azmin Ali however recently said that Malaysia had attracted new investments worth RM16.52 billion from the US.

He also said that Malaysia was in talks with Starlink, the high-speed, low-latency broadband internet provider operated by Musk’s aerospace company SpaceX, on introducing satellite internet service in the country.

Hezeri Samsuri of Careta.my said Musk’s decision to go with Indonesia was partly due to the country’s production of cobalt, a raw mineral needed to produce batteries.

“The whole world understands why Elon Musk chose Indonesia,” he said. “They have that mineral and need to process it in the country itself.

“If they didn’t get Tesla’s investment, it’s not impossible that they would have attracted the attention of companies like Samsung or LG to open up a factory there.”

Hezeri also said that Malaysia was still an attractive market for car sales, adding that many foreign automotive companies had come to ask before how to set foot in the country.

“Although our population ratio is not as big as that of Thailand and Indonesia, in Malaysia, orders for premium cars like BMW can reach more than 1,000 units,” he said.

“Even brands like Hyundai and Volvo don’t have enough stock. Buyers have to wait for months in order to receive the cars they ordered.”

He said this meant that consumers in Malaysia had a strong grasp of the technology involved and could easily adapt.

“We also have Proton and Perodua,” he said, referring to Malaysia’s national cars.

“This proves that we already have better skills and expertise than our neighbours.”

Subscribe to our newsletter

To be updated with all the latest news and analyses daily.