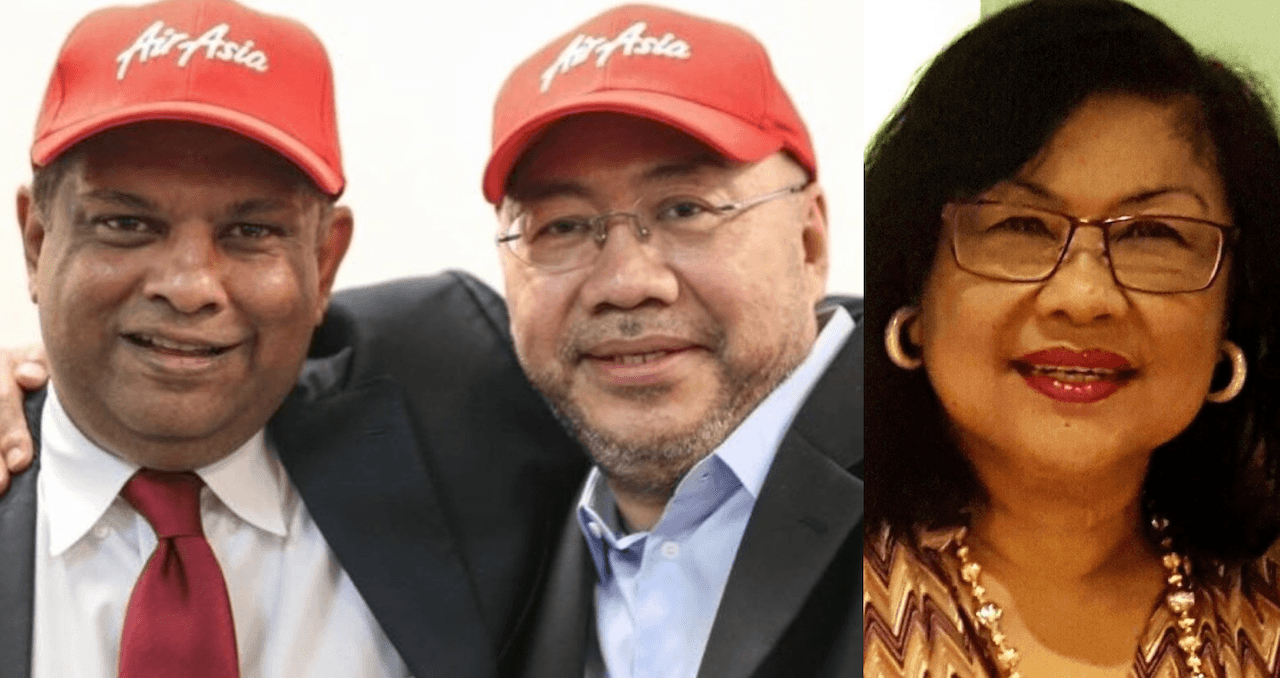

AirAsia top duo paid RM4.8 million each in 2020

Meanwhile many passengers have been demanding their money back for flight cancellations.

Just In

The annual reports for the financial year ended Dec 31, 2020 (FY20) for AirAsia Group Bhd, now known as Capital A Bhd, and AirAsia X (AAX), show that Tony Fernandes and Kamaruddin Meranun received an annual salary of RM4.8 million each, while board members were given fees in the hundreds of thousands of ringgit, even as the airline dealt with the impact of Covid-19 following the worldwide freeze on air travel.

Meanwhile, according to AAX’s annual report for the financial year ended June 30, 2021, former minister Rafidah Aziz, who is a senior independent non-executive chairman, was paid RM401,500.

Other board members received annual fees ranging from RM150,000 to RM280,000 as well as meeting and travel allowances amounting to tens of thousands of ringgit.

The reports came as the carrier posted a series of losses due to the Covid-19 pandemic.

In September 2021, AAX posted a record quarterly loss of RM24.6 billion for the April-June period, eight times more than the previous year. It was the airline’s ninth successive loss.

Last year, the group posted a net loss RM887 million for the third quarter ended Sept 30, 2021, up 4% from RM851.78 million in the corresponding quarter in 2020.

AAX, meanwhile, faces the issue of refunds demanded by passengers whose flights were cancelled over the past two years since the onset of the Covid-19 crisis.

MalaysiaNow understands that many have yet to receive their money back.

In April last year, Fernandes assured some 450,000 customers waiting for refunds would get their money back, adding that AAX had been facing financial problems.

“AirAsia X is in deep, deep financial difficulty because it just hasn’t been able to fly anywhere. Plus it has had to deal with very unfair competition over the many years,” he said.

On Nov 12 last year, AirAsia said that its RM33.65 billion debt settlement scheme for AAX had been approved by 99% of its creditors through a vote at a meeting held that day.

“A lot has also been written about the classification of passengers as creditors. In a financial statement, besides being a shareholder, there are only two categories. A party is either a debtor if they are owing money to the company or a creditor if the company owes them money. It is clear that the company owes the passengers who have outstanding amounts owed to them, and hence the classification as creditors.

“We assure all passengers affected by the restructuring that it is the firm intention of AAX to put in place travelling privileges in the form of travel credits, which can be utilised for future purchases of flight tickets once international borders reopen on top of the 0.5% they will receive and other cash based entitlements based on annual revenue performance over three years as explained in the explanatory statement issued to all creditors recently.

“Please note that these entitlements and the travel credits can only take place if AAX is successfully restructured pursuant to the terms of the scheme. If the terms of the scheme are not complied with and the scheme fails, AAX will go into liquidation and the passengers will not receive anything in return. It is not the intention for AAX to place the passengers in this situation,” it said.

On March 16, AAX in a separate statement said the company had lodged a sanction order for its debt restructuring with the Registrar of Companies with the formalities of the restructuring now completed.

It said the lodgement of the sanction order meant that the financial effects could be recognised in the financial statements of the company and that, as a result, AAX would be able to reverse RM33 billion in liabilities and provisions for liabilities which have been waived under the scheme.

Subscribe to our newsletter

To be updated with all the latest news and analyses daily.