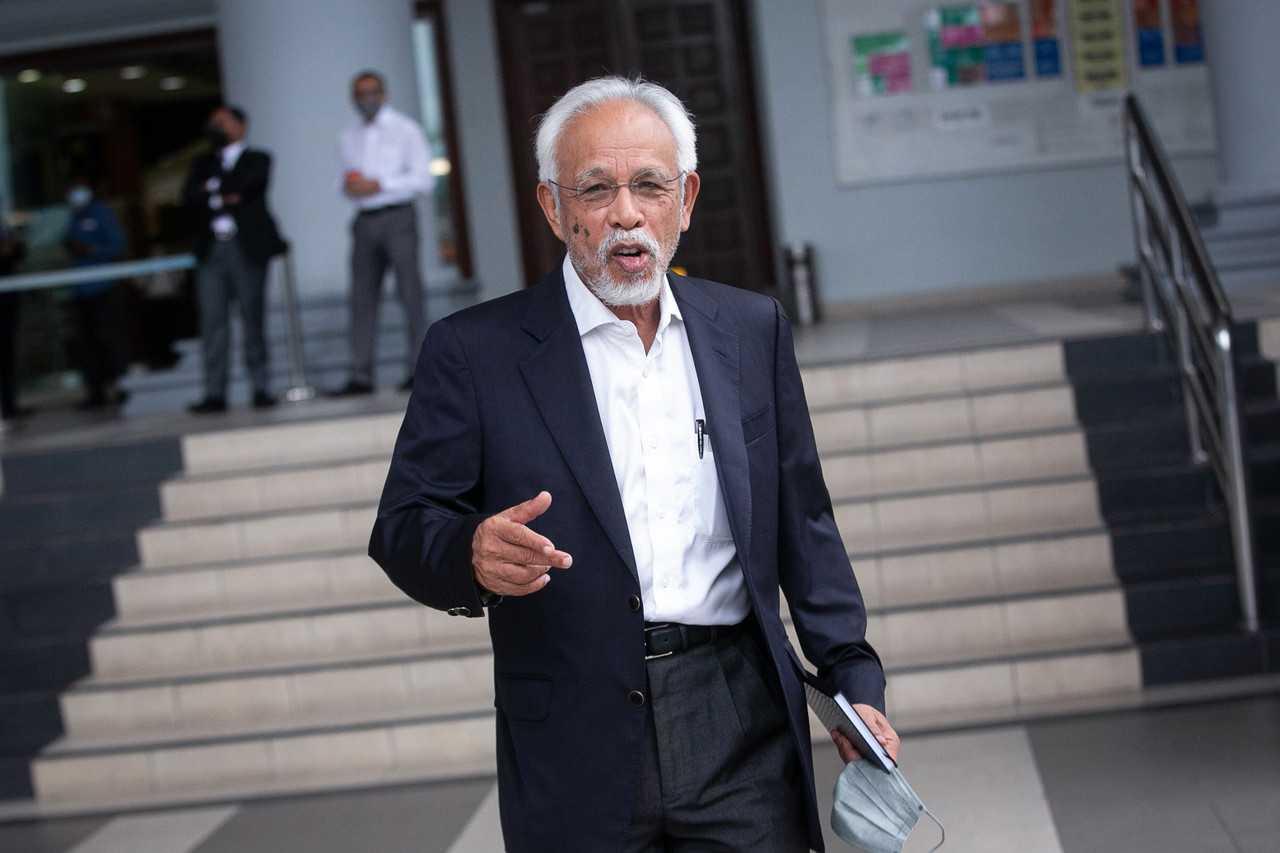

Ex-Felda boss Shahrir bought Honda Civic worth over RM100,000 with just one cheque, court told

He made full payment for the car, worth RM118,485, through a cheque on Dec 21, 2013.

Just In

The Kuala Lumpur High Court was today told that former Felda chairman Shahrir Samad bought a Honda Civic hybrid car worth RM118,485 nine years ago, and completed the payment with just one cheque.

Sutera Auto Sdn Bhd account executive Rozana Khalid, 43, who was involved in the process of closing the account for the purchase of the vehicle, said Shahrir made full payment for the white car using a cheque, on Dec 21, 2013.

Rozana said this while reading her witness statement at the trial of the former Johor Bahru MP, who is charged with failing to declare RM1 million which he received from Najib Razak to the Inland Revenue Board (IRB).

The seventh prosecution witness also confirmed a copy of the cheque for RM118,485 and the payment receipt, shown by deputy public prosecutor Rasyidah Murni Azmi.

During examination-in-chief by Rasyidah Murni about the meaning of cash payment, she said there were three ways of making cash payments: cash, credit card and cheque.

However, Rozana said the probability of a person paying for a car in cash was low, at only 1% or 2%.

"Normally, car buyers will take out a bank loan. For example, out of 50 units of cars sold, maybe two or three people will buy in cash and the payment will be made either in the form of cash or credit card," said Rohana, who has been with the company for 13 years.

Earlier, the court also heard testimony from the company's administrative executive, Nurrul Hafizah Md Roslan, 40, who was the prosecution's sixth witness, regarding the invoices prepared after the payment and vehicle registration was completed.

Shahrir, 72, is charged with money laundering by not stating his real income in the income tax return form for assessment year 2013, which is a violation of Section 113 (1)(a) of the Income Tax Act 1967, regarding the RM1 million, believed to be from unlawful activities, which he received from Najib through a cheque.

He was charged with committing the offence at the LHDN Duta branch, Government Office Complex, Jalan Tuanku Abdul Halim on April 25, 2014.

The charge, framed under Section 4(1)(a) of the Anti-Money Laundering, Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001, provides for a maximum fine of RM5 million, imprisonment of up to five years, or both upon conviction.

The trial before judge Muhammad Jamil Hussin continues tomorrow.

Subscribe to our newsletter

To be updated with all the latest news and analyses daily.